Coca-Cola leads the country’s cola market with over 42% share out of an estimated Tk1,800 crore market

Bottles of Coca-Cola are displayed at a supermarket of Swiss retailer Denner, as the spread of the coronavirus disease (COVID-19) continues, in Glattbrugg, Switzerland June 26, 2020. REUTERS/Arnd Wiegmann

“>

Bottles of Coca-Cola are displayed at a supermarket of Swiss retailer Denner, as the spread of the coronavirus disease (COVID-19) continues, in Glattbrugg, Switzerland June 26, 2020. REUTERS/Arnd Wiegmann

Global beverage giant The Coca-Cola Company (TCCC) is going to sell its Bangladeshi bottling business Coca-Cola Bangladesh Beverages Ltd (CCBB) to its Turkish associate Coca-Cola İçecek (CCI).

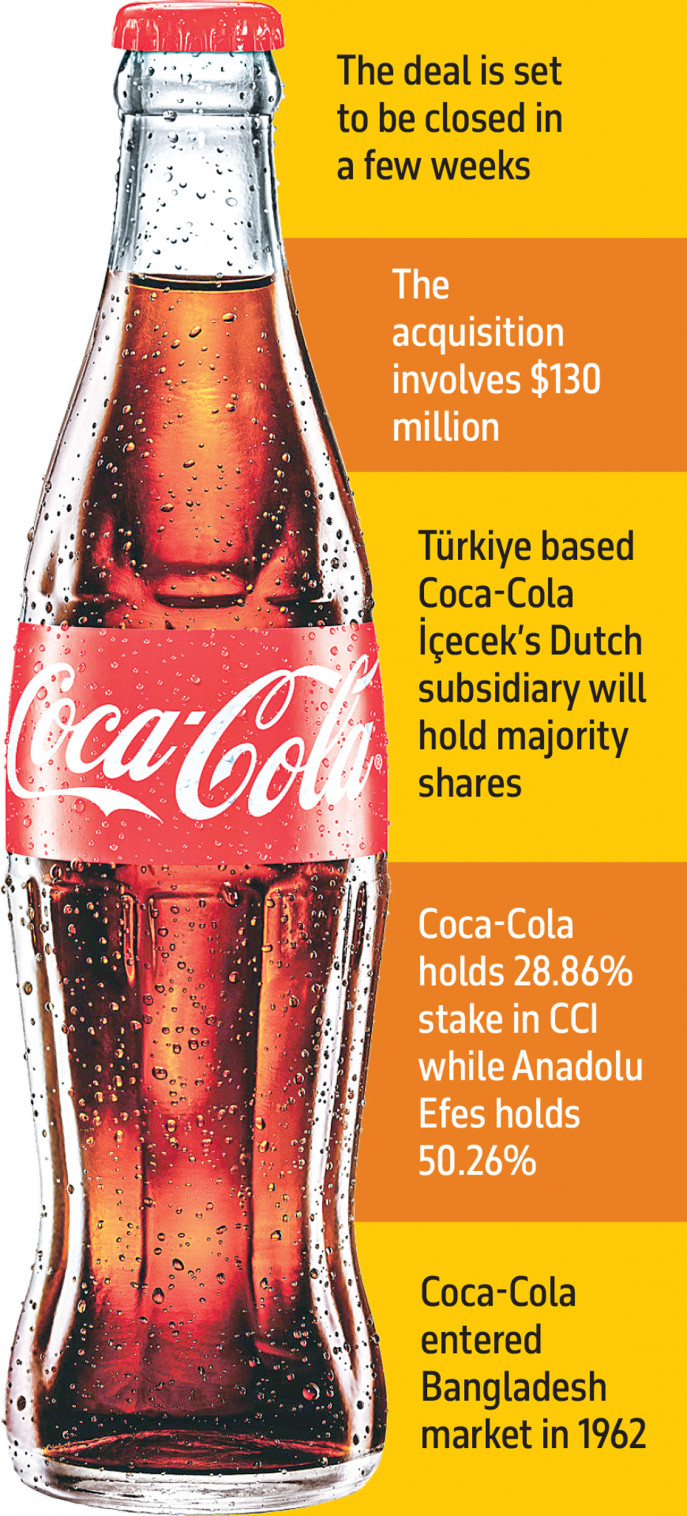

Istanbul Stock Exchange-listed CCI, taking over the Coca-Cola bottler to make Bangladesh its 12th Muslim-majority market, said in a press release on Thursday that the entire stake of CCBB would be priced at an enterprise value of $130 million subtracted by the net debt of the company at the time of the deal’s closure.

According to the deal, CCI, in which Coca-Cola holds a 28.86% stake and Turkish beverage giant Anadolu Efes owns 50.26% shares, would allow its Dutch subsidiary CCI International Holland BV to hold the majority shares of CCBB, while CCI itself would own minority stakes.

CCBB declined to comment immediately.

Sources, however, told TBS that the acquirer would buy the Bangladeshi company from Singapore-based Coca-Cola Holdings, a subsidiary of The Coca-Cola Company based in Atlanta, USA.

The deal is expected to be closed in a few weeks, as CCI eyes to grab the opportunities in the fast growing beverage market in Bangladesh, said a senior Coca-Cola official while talking to TBS seeking anonymity.

Commenting on the acquisition, CCI CEO Karim Yahi said in a statement, “We are very pleased to sign the share purchase agreement to acquire CCBB, which we see as a great opportunity to enter a market with significant future potential, where growth and value can be generated by deploying CCI’s core capabilities. This acquisition also creates a more diverse geographical footprint for CCI and solidifies its alignment with TCCC.”

Illustration: TBS

“>

Illustration: TBS

CCI produces, distributes, and sells brands of The Coca-Cola Company in Türkiye, Pakistan, Kazakhstan, Iraq, Uzbekistan, Azerbaijan, Kyrgyzstan, Jordan, Tajikistan, Turkmenistan, and Syria. It employs more than 10,000 people, operates a total of 30 bottling plants, and owns three fruit processing plants across 11 countries.

Coca-Cola bottling in Bangladesh

Coca-Cola entered Bangladesh in 1962 with the help of its then bottling and distribution partners Tabani Beverage in Dhaka and K Rahman in Chattogram. In the 1980s, another homegrown company, Abdul Monem Ltd, with its own bottling plant, joined the business.

However, neither of the first two partners sustained their business with Coca-Cola in the long run.

By 1990, Coca-Cola had captured more than two-thirds of the small beverage market, with its competitor PepsiCo lagging behind.

Tabani Beverage, a concern of the Freedom Fighters’ Welfare Trust, had its business agreement with Coca-Cola terminated in 2008. In 2009, Coca-Cola itself opened International Beverages Private Ltd to replace Tabani.

In nearly a decade of reliance on partner bottlers to cater the Northern Bangladesh market previously handled by Tabani, Coca-Cola saw a significant drop in its market share, while several homegrown players, along with PepsiCo, gained ground.

However, International Beverages, which became CCBB after the pandemic, turned things around with its own plant in Bhaluka, Mymensingh, established in 2017.

According to Coca-Cola officials, with the gradual capacity expansion at own plant that saw around $110 million in cumulative investments, CCBB now caters around half of the Coca-Cola market for the sparkling beverages and bottled water in Bangladesh as its distribution area covers, Dhaka, Mymensingh, Rajshahi, Rangpur regions.

Pran Dairy bottles nearly 5% of Coca-Cola products on behalf of CCBB, while Coca-Cola’s franchisee, Abdul Monem Ltd, bottles and distributes 40%-45% of Coca-Cola products across the Chattogram, Sylhet, Khulna, and Barisal regions.

The Bangladesh market for non-alcoholic ready-to-drink beverages grew at a compound annual rate of 10% from 2019 to 2022, according to CCI. It anticipates the growth rate to rise to 12% for the 2023-2032 period.

The annual demand for ready-to-drink non-alcoholic beverages is expected to reach nearly 72 crore unit cases by 2032, up from 41 crore unit cases in 2022.

Beverage marketers’ research reveals, of the estimated Tk1,800 crore cola market in the country Coca-Cola leads with more than 42% share, while its white sparkling drink Sprite lags with some 22%-23% market share behind 40% market share of Pepsico’s 7 Up in the segment of Tk2,700-2,800 crore market.

Also Coca-Cola’s orange soda Fanta significantly lags behind its competitor Mirinda in the smaller market segment of an estimated annual value of Tk350 crore.

CCI said that Coca-Cola secured five consecutive years of strengthening its competitive position in Bangladesh. In 2023, it emerged as the market leader with over 45% share of the value of all sparkling beverages sold in the country.

Akij, Partex, Pran, Meghna are the local contenders in the sparkling soft drinks market estimated to have crossed Tk5,000 crore a year, already.

Besides, the bottled water market grew to around a thousand crore taka a year, while energy drinks and various fruit-flavored drinks surpassed bottled water in terms of value.

Stake transfer: A marketing drive?

When western brands like Coca-Cola and Pepsi remained silent about the Israeli oppression in Gaza, the homegrown cola brand Mojo launched its “Support Palestine” campaign a few months ago. Under this initiative, Tk1 was deposited to a fund for the donation to Gaza’s civilians affected by the war.

As the Muslim people of Bangladesh are in a strong solidarity for the civilian victims at Palestine, Mojo’s sales spiked up, said Md Maidul Islam, chief marketing officer of Akij Food and Beverage Ltd which owns the brand.

In two months Mojo’s market share grew by five percentage points to 34% in the cola segment, he added.

Coca-Cola, on the other hand, had to cut prices for some of its cola bottles this winter following the cost hike-led price increases last year.

Speculation intensifies among observers if Coca-Cola eyes tackling the marketing problem by handing over its own bottling plant to the Turkish firm, successful in 11 other Muslim-majority markets.

However, Coca-Cola Company has long been demonstrating its business strategy preferring asset-light operations through letting partners lead the bottling across continents and having full control over the concentrate supply business and the branding and marketing.